There’s a great David Sedaris essay where he talks about what he misses most about living in America – Sedaris was living full-time in France at the time – and one of the things he missed the most was our very gauche American habit talking about money, and the love of talking about money. I LOVE talking about money. I don’t mean that I enjoy it when rich people talk about being rich, although I do hate it when rich people try to be “oh, I’m so normal and middle class!” I just like talking about money generally. How much is her yearly salary? How much cash on hand should he have? Do they have a Money Market Account? At what age should I start a Roth IRA? That kind of thing. Well, the site Wealthsimple.com has created a feature just for me: celebrities talking about money, and their history of financial messes. Anthony Bourdain had an IRS problems. Anthony Bourdain didn’t have a saving account until he was 44 years old! You can read the full piece here. Some highlights:

No savings account for much of his life: “I don’t want to sound like I’m bragging about this, but the sad fact is, until 44 years of age, I never had any kind of savings account. I’d always been under the gun. I’d always owed money. I’d always been selfish and completely irresponsible.

Early adulthood: “I didn’t put anything aside, ever. Money came in, money went out. I was always a paycheck behind, at least. I usually owed my chef my paycheck: again, cocaine.”

Living on borrowed money: “When I was a working cook and chef, going to the Caribbean was always the great indulgence. I’d find myself either with a fresh credit card, or maybe having somehow paid down the previous one though I don’t remember actually ever doing that. We’d go to the Caribbean, stay as long as possible, and burn through all the credit on a card. I’d have to quit my job to go, but when I came back there was always work. I changed jobs an average of about once a year.

His first taste of fame: “When Kitchen Confidential was published, I hadn’t filed taxes in about 10 years. I was seriously behind on rent. It had been about a decade since I’d communicated with American Express in a timely manner. In my daily life, the goal was to muffle the anxiety that I’d feel as I tried to drift off to sleep knowing that, at any point, what little money I had in my bank account could be garnished by the IRS or the credit card company. The landlord could kick me to the curb. That was my reality for many years.

He only learned about saving money when he became famous: “That was really the first time I started thinking about saving money… In very short order, I contacted the IRS and I paid what I owed. I paid American Express. Since that time, I am fanatical about not owing anybody any money. I hate it. I don’t want to carry a balance, ever. I have a mortgage, but I despise the idea. That was my biggest objection to buying property, though I wasn’t in the position to pay cash.

He still doesn’t live sensibly: “The reports of my net worth are about ten times overstated. I think the people who calculate these things assume that I live a lot more sensibly than I do. I mean, I don’t live recklessly — I have one car. But I don’t deprive myself simple pleasures. I’m not a haggler. There’s not enough time in the world. I tend to go for the quickest, easiest, what’s comfortable. I want it now. Time’s running out.

He still doesn’t pay much attention to his investments though: “I’d like my daughter and her mom looked after, both while I’m alive and after. They shouldn’t have to worry if something bad happens, so my investments and savings are based on that. I’m super-conservative… My investments advisor understands that I’m not looking to score big on the stock market or bonds. I have zero understanding of it and zero interest. Life is too short. I like a limited amount of mail, and a limited amount of conversations with people who make the investments. If the money’s not less money every time I look at it, I’m pretty happy. If it’s a little bit more, great.

Paying taxes: “Nobody likes paying high taxes, but I don’t mind. Maybe that’s a luxury, but I don’t need to hire some hotshot to spend 12 hours a day figuring out how to chisel the government out of an extra few thousand dollars. If getting that extra money means a lot of phone calls and talking to financial analysts and lawyers, I don’t want it. I don’t want to have those conversations. A friend said, “You live outside the country more than half of the year. Create a bogus residence in the Caymans and pay no U.S. taxes.” I’d feel like a sh-t doing that. I’m an American. I don’t want to be that guy.”

There are many references to drugs in his early years – I knew that Bourdain liked to “partake” in his youth, but I guess I didn’t realize he spent his teenage years, his 20s and much of his 30s in a marijuana and cocaine haze, which YEAH is totally a factor in his money management skills. What’s interesting to me is that I never really thought of financial illiteracy as a generational thing, but it totally is – kids learn how to deal with money stuff from watching their parents. Bourdain says his parents always worked but always spent more than they had, which explains a lot about his early years. Even though I like to consider myself financially literate, I have to admit that I invest the same way as Bourdain – low-risk, no drama, just tuck away some money and be done with it. I also hate to owe anything, it makes me feel itchy right now that I have a balance on one of my credit cards. Still, I’ve had a savings account since I was a kid. So I feel a little superior to Anthony Bourdain.

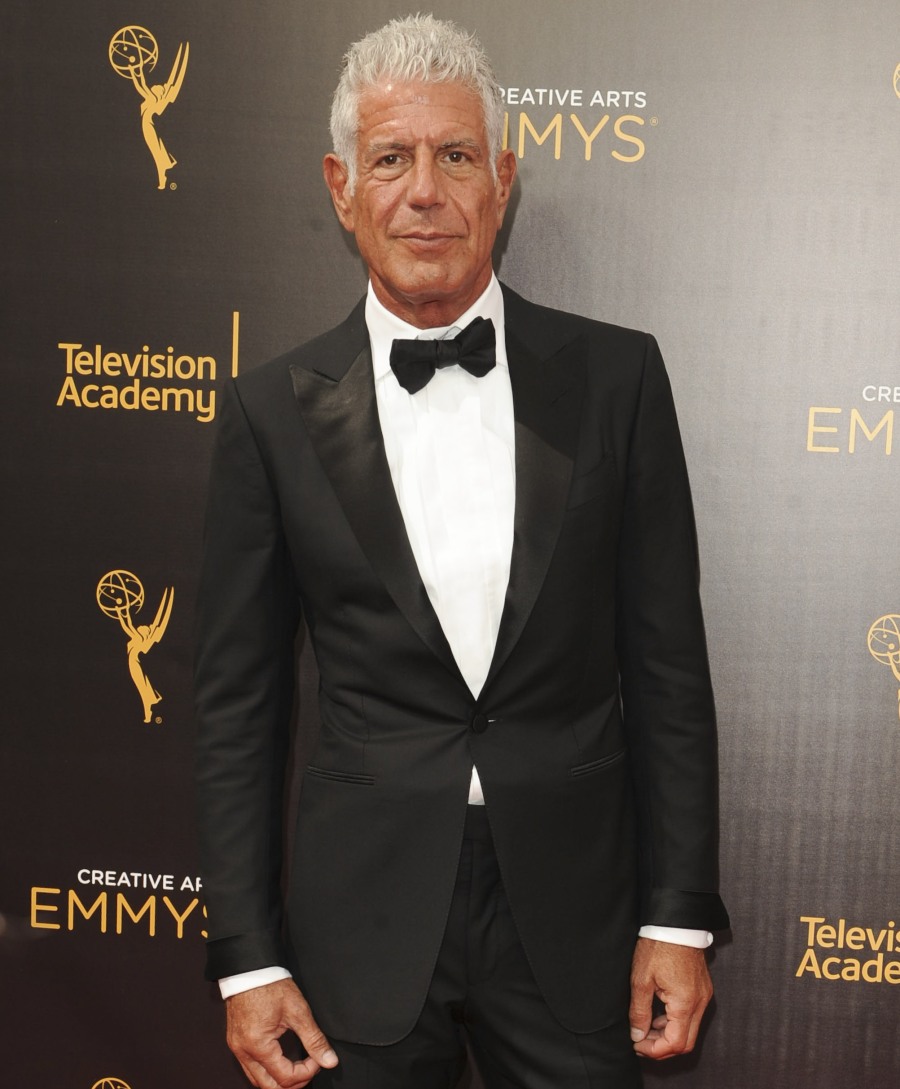

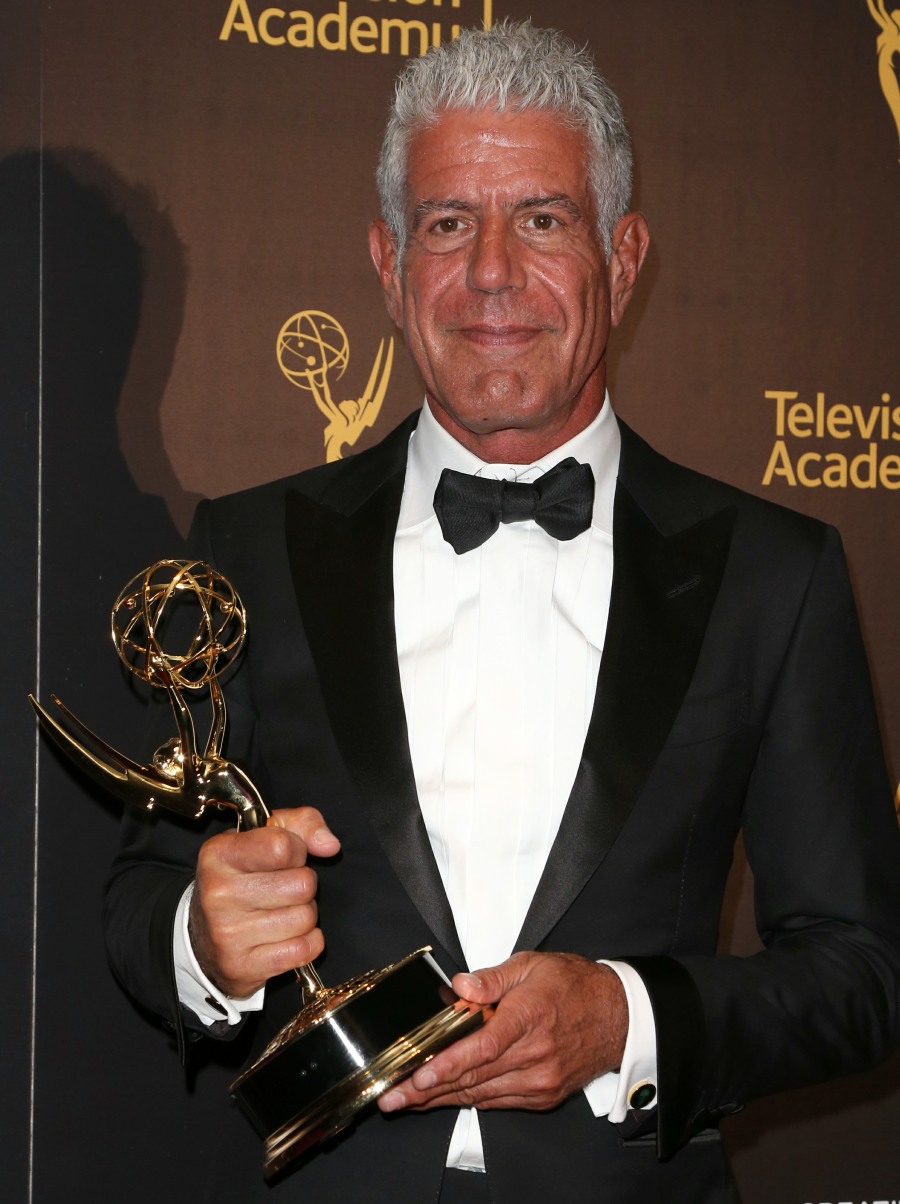

Photos courtesy of WENN.

I’m not gonna shade him, only the past few years and I wanna say 5 or so so “In My 30s” ive become more conscious to have some back up money, sometimes it isn’t much but It’s become an ER fund with living expenses, I stowed some away for a certificate, am currently letting my apt accrue equity (but Ultimately want to sell it) and got info about my boss’ 401K for us, I also got Credit Karma on my phone and behind that me and my sister have really really improved our credits and made moves towards minimizing our debts, we pay chunks on the card, have refinanced things accordingly, but it’s been basically in our 30s is not like my mom hasn’t drilled into us about this, but we had to overcome being seduce by credit and sh*t like that…

i dont want to be the person with the most savings who dies with a pile of money in the bank, i want to enjoy it

it’s hard to know the right balance betw preparedness and not enjoying it

That’s the way my grandparents should have been. They were wealthy but didn’t like to spend much. My grandmother died in her 60’s and my grandfather had alzheimers disease for 20 years. Enjoy money.

One of the first topics that came up between my now-BF and I on our first date: how much debt do we have? He had none and I was in the low 4 figures (expensive college vs state school). This stuff is important with an ever-shrinking middle class. I wish high schools had a Life Skills class.

It’s funny that you mention the “Life Skills” class, I did have something like that in high school and it helped a lot. It wasn’t anything major (we weren’t trying to figure out how to cheat on our taxes, lol) but we learned the difference between simple and compound interest, how to make a budget, and so on.

My brother teaches history in college and he actually sets aside a day to explain the basics of finances / budgeting to his 1st year students, because so many of them have zero clue. From what I’ve heard they really do appreciate it…it is important indeed.

As a person who worked in finance for a long time this makes me nuts. If there is one thing I want young people to know is the magic of compounding. Even w low interest rates now, there are ways to grow your savings. INVEST!

its too slow….especially at current rates. (It aint the 80’s anymore)

I don’t own a credit card and we have bought everything we have with cash, including cars. The only thing we owe is the living expenses such as utilities ect. If we can’t afford it with cash, we don’t do it. The reason for that is because I saw first hand what living outside your means can do and It freaks me out. I don’t want to get older, retired and scared.

The only debt I have right now is… idk if it’s right to call it mortgage, but if mortgage is the debt you get to buy a home, be it a house or an apartment then that’s it. The only debt I’ll ever have. It’s not easy in my country to get a credit card when you don’t make a certain amount of money monthly. I’m actually pretty grateful for that – I’m poor, but I don’t have to fear overspending the money I don’t have. Yes, it’s miserable when I literally count my copper coins at the till during the last week of the month, but you know what? No crippling debt. No fear.

As for retirement, well, here’s hoping that when my hands or eyes no longer work (I’m an illustrator), I can pass on my own terms and with dignity, without languishing in poverty without a means to make money anymore.

Smart man, enjoyable entertainer. Big mouth, therefore liable to fit a whole foot in it sometimes. But honestly? If it’s true that he didn’t have savings until 44, it makes me feel better. I’m young, turning 26 this fall, have one sh**ty useless degree in English (not a native speaker of the language, but in my country the degree is useless regardless), quit another school due to crippling depression and hating receiving alms from my parents at my age. Right now I’m raking in coppers from freelance illustration and… mailman work.

His reason was drugs, mine is alcohol and horrid commitment phobia (daily routine work messes me up, I hate the permanence of it, the ‘career’). But I don’t owe anybody anything (another deathly fear, owing someone), I can very rarely tuck away some crap (getting my teeth fixed from said ‘crap’ right now. Edge of poverty, sure, but teeth are important).

And it makes me feel less alienated, less miserable, knowing that even successful people didn’t have their shit nowhere near together around my age. I’m shite with money. Always will be. Nice to know that it doesn’t have to be a ‘death sentence’. And I don’t mind paying taxes either. At least in my mud pool of a tiny country, I know that my tax money is mostly used for the citizens’ benefit despite corruption.

So in this round of comments, I like Bourdain. He sounds clear-eyed about his finances. That’s pretty cool.

I also have no credit card, and I hope I’ll never get one. God knows I’d be spending like a beast and fall in debt.

Didn’t homie come from a rich family in the first place? Because it’s a lot easier to be the prodigal son when Mommy and Daddy can provide you with a soft silk cushion to fall on when you return.

There’s this thing where kids of rich parents experience first hand the thing where “the parents are rich, i am not”. And if he was as obnoxious as he says he was…

You’re right though. Even obnoxious kids of well-off parents have a safety net. So in that way fella got a leg up.

Did they though? He was *very* addicted. Maybe they tried the tough love route.

Even though we have retirement savings and own a home, I still feel that the rug may be pulled out from under us.

I’m a social worker in my late 30s and don’t have any savings. I just got my working hours reduced and that means of course less money. I’m lucky if I still have my job in four months, so I don’t see any savings in the near future.

His honestly is refreshing.

Just wish he’d lay off the red lobster tan.

i can’t shade him. My husband and I only recently started getting serious about savings and investments because we got pregnant with our second. Kids really put stuff into perspective for you. They now have their own college funds set up with investments going there, as well as life insurance policies on both me and my husband. It’s morbid and horrible to think about but when my dad died my mom was left in debt, and I would hate to see my kids or husband go through that.

I have 2 master’s degrees (in useless fields), six figures of student loan debt, a mortgage just outside of Boston, no savings, and a very, very low-paying job (think basically minimum wage). I’m 39. I wish I’d learned about good money management much, much earlier. I’ll be paying over $1000 month to student loans for 25 years. It sucks. I was dumb. Live and learn…. I will always, always be very poor. I have panic attacks in the middle of the night at least a few nights a week. Oh well.

@themummy Please inquire into loan forgiveness. It’s a lot more than K-12 teachers who can apply. Loan companies don’t share this info because it means you could be forgiven after 10 years of low monthly payments. I just found out about it. Only need to be working 30 hours per week for, I think, 8 months of the year.

Anyway, hope this might help

I feel I relate somewhat. Mr B and I are in our early forties. We don’t own a home, we have credit card debt and no savings. Only this year did I put together a budget that will have us (with my wage alone) a $10k emergency fund. I can also pay off my credit card debt.

I had a minor accident that put me out of work for 6 weeks earlier this year. Fortunately, I still got paid but hubby is self-employed. If he had an accident, we’d be screwed. He doesn’t see this though. He plods along spending money like it’s going out of style. He bought a $14k motorbike last year without discussing it with me. I’m still not over it.

I’ve had two major meltdowns about our finances and a panic attack, yet nothing’s changed from his point of view. I’m so scared for our future 😢

Sorry for the rant. The stress never lifts.