I recently ended up with an unexpected $3,000 in medical bills (I have insurance with a really high deductible), and I’m waiting for my student loan payments to kick in. So, I’m constantly thinking about money and how I’d love to find more of it lying around somewhere. Every so often, I fantasize about some distant relative whom I’ve never met showing up and writing me a check. That’s never going to happen, of course, but a girl can dream.

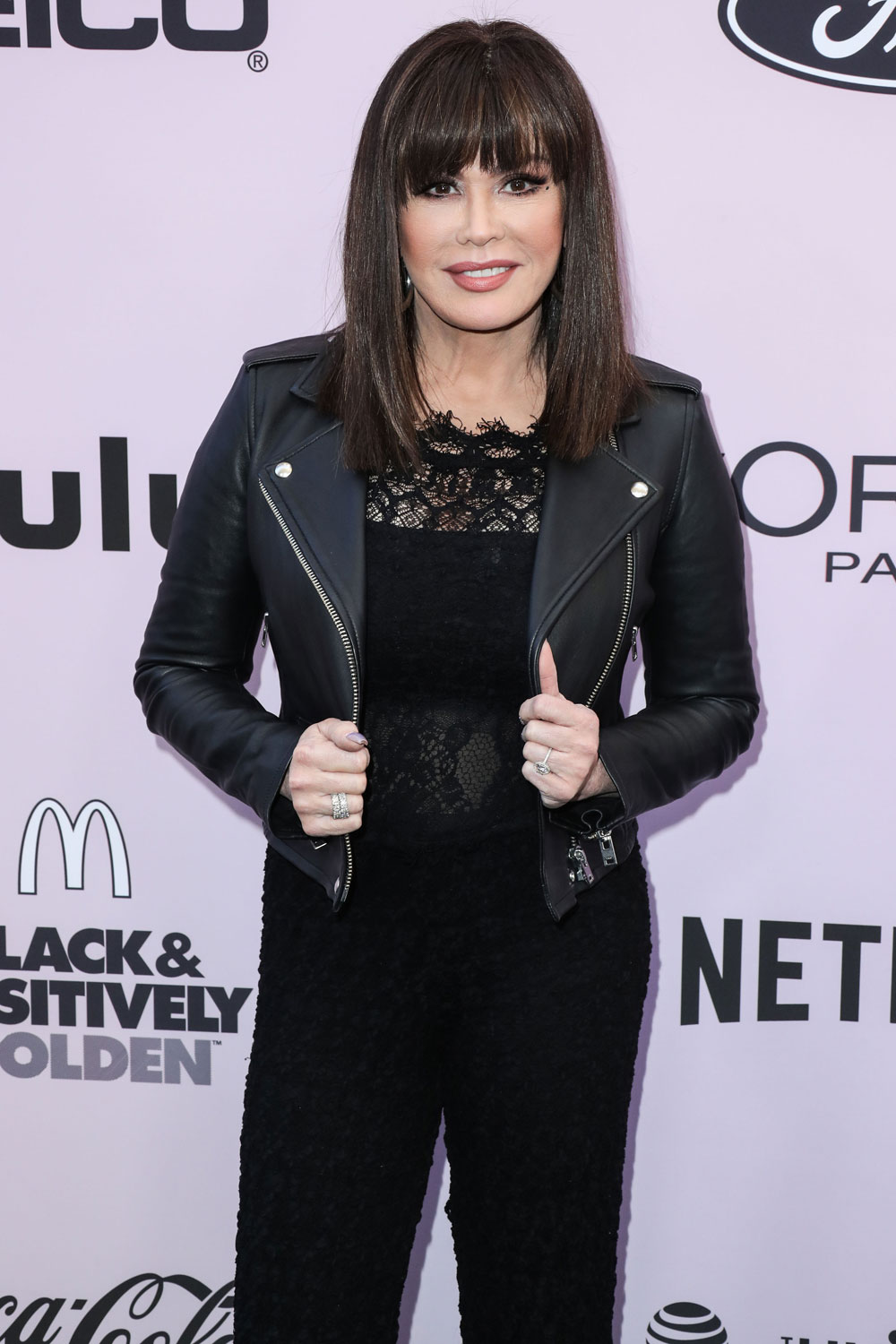

On Friday, Marie Osmond told her fellow The Talk cohosts that she has no plans to leave any of her fortune to her children. Marie is going to leave her money to charity. She made it seem as though she were telling her children this information for the first time, too:

“I’m not leaving any money to my children. Congratulations kids,” Osmond said of her six children from her marriages to Stephen Craig and Brian Blosil.

“My husband and I decided, I think you do a great disservice to your children to just hand them a fortune because you take away the one most important gift you can give your children and that’s the ability to work,” she explained of her decision with current husband Craig.

Sheryl Underwood disagreed with Marie, saying that “When you come from a family of money, you raise your children to value money and to understand money.”

I’m sure Marie’s children already know that she’s not leaving them any money. (A quick note: Marie has eight children, one of whom, Michael, passed away 10 years ago.) Marie isn’t the only celeb who plans to leave her money to charity. Elton John and Nigella Lawson both echo Marie’s sentiment about the potential danger of leaving children a lot of money. I also love Sting’s brutal honesty that his children won’t have an inheritance because he and Trudie Styler are “spending it!”

I think that if you have an incredible amount of money, leaving it to charity is a lovely idea. That will help more people than leaving an inheritance for children. I also agree with Sheryl Underwood that it’s possible to raise your children with a healthy respect for money, and if you expect your children to work and earn a living, giving them money isn’t necessarily going to ruin them. I’m sure Marie’s children aren’t planning on an inheritance from Mom, and will be fine. She’s probably going to leave them other things that they’ll appreciate, but I don’t think it would be terrible if she left them a little money, either.

Photos credit: Avalon.red and Getty

I don’t think leaving your kids money is what kills their work ethic. It’s having everything given to them when they’re kids and never developing a good work ethic that usually causes that problem. Someone who has a good work ethic won’t just stop working simply because they have money. They might shift their career to something more charitable, but they wouldn’t simply stop working.

Right. I always think about Anderson Cooper, who could easily have had a much cushier life but instead chose a really hard road as a journalist. Clearly he was raised to have a strong work ethic and I think his mom was the same despite having come from one of the country’s wealthiest families.

I’d like to think if I were in that position, I’d find a balance between leaving some money for my kids and the rest to charity.

Love Anderson Cooper and he is a great example of this.

Agree 1000%

I agree 100%. It’s all about how you do it. Liesel Pritzker Simmons isn’t exactly sitting around IG’ing herself all day with her hundreds of millions (spoiler: she set up a social investing fund and manages it with her husband). Kelly Rohrbach’s husband is one of the Walton heirs (net worth around $3 bill if I remember right) and he and his cousins are all busy taking over the world (virtues of that another argument) and hardly doing nothing or gambling/spending it away on worthless activities.

Chuck Feeney is one of the most extreme examples and like Marie Osmond he decided to leave his kids with nothing. The world isn’t a level playing field; there’s nothing wrong with giving your kids a leg-up while paying your taxes as long as you show your kids how to manage money responsibly. Quimby, I hope you get a nice big windfall coming your way soon.

Considering most people are well into adulthood when their parents pass, they’re only not going to have a work ethic if they’ve been financially supported their entire lives.

Yeah, no. Marie, if your kids are somehow crippled at the idea of having to work when they are left money, you’ve been a shit mother, period.

Curious as to whether the kids have had trust funds their whole lives. Many wealthy people don’t leave their money to their kids to inherit; they already provided for them through trusts.

Everyone has a way.

This is hers.

I like Warren Buffet’s rule of thumb – leave your kids ”enough money so that they would feel they could do anything, but not so much that they could do nothing.”

In my case knowing that my family was broke worked as a motivation for me. If you know that the only things that you would get in this life are the ones that you get with your own efforts you will learn how to work. It made me excel in school, it made me work hard, it became my motivation. I have seen people with much more better backgrounds and they don’t do anything with their lives because they are counting on the inheritance they will get some day.

Her kids were born on third base. They have more than enough privilege and access to succeed without her money.

Yup! And I’m sure there educations were paid for, and probably a nice down payment on a house.

I’m waiting for one of these people who say this to actually do it. That is, leave nothing to a child with whom they have a healthy relationship, and who is a functioning adult.

Marie has been working since she was about 5 years old. She has Never. Stopped. Working. That was a family who worked, HARD. And she and Donnie kept on, even when the other family members were not full time show biz. If her kids don’t see what it means to have a work ethic by now, they will never see it.

Eh, her working so much might actually be one reason she didn’t have time to teach them about working hard. Kids might not have seen anything but an absentee parent modeled for them. I don’t know if this is true, of course, but I do know that just working hard isn’t enough to teach your kids about working hard. You have to talk about it, reinforce it, be consistently present for them. Imo.

I agree with Esmom but instead of working hard I’d put “teach them about managing money and finding your passion.” Do something you like, love, enjoy, or at least find meaningful, whether it’s working in a bookstore, volunteering, or working as a high-powered professional. Don’t work just to prove you’re worthy of something; do something that is meaningful and at least enjoyable to you. Not everyone has a burning passion but everyone can find some meaning in some type of “work.”

My sister and I will not be getting a penny and I have no problem with that – you should earn your keep and not expect anyone else to dig you out of a financial hole. Although saying that, I am lucky not to have to worry about medical bills as I live in the UK.

My mother decided that leaving your children large amounts of money was a bad idea after one of her friends gave her son access to his trust fund at the age of 25. He promptly quit his job and travelled around Asia for several years before dying of a heroin overdose at 31.

It’s a very interesting debate.

I personally know two people who have benefited from their parents inheritance in their lifetime.

The first person is my brother in law.

He was given two pieces of real estate by his parents. He still have to work, but has been able to follow his passion, which doesn’t pay well, whilst having a great lifestyle with his family (a lot of time off and a place in an expensive area).

However he doesn’t have much of career and hasn’t changed the world with it.

The second person is a close friend.

He has also been given a piece of real estate that he rents out. In order to live off the income, he has returned to live with his parents, although he is a grown up adult (over 30) with a girlfriend.

He is a very clever and a well educated guy. In my opinion, this gift has prevented his from developing and realising himself. He doesn’t see the point of working. Will inherit from his parents large estates when they pass away anyway. But he has so much to give to the world! It’s a such a waste.

Actually his father who is frustrated by his lack of direction has often told him he regretted his gift.

So I understand why some parents do not want to leave their fortunes to their children.

It’s probably better to give on’e children a good education, and the connections to succeed.

It is an interesting debate. And having seen it myself, getting an education and connections to succeed doesn’t necessarily work out if said person acts entitled at the workplace and isn’t willing to learn and grow and work as hard as everyone else. We had a few guys come onto my team (I worked in advertising agencies for years) like that and they were terrible, just terrible, co-workers.

Which then made me hesitate to ever recommend anyone I know for a job (no matter how great I know they might be) because I didn’t want to be blamed if it somehow worked out as badly as that, lol.

On the flip side, my husband once recommended a friend for a job, who has gone onto incredible success that wouldn’t have been possible without the door my husband opened. We laugh sometimes about how my husband single handedly gave him his big break, while he himself has stayed lower level. Sigh.

It doesn’t take away their ability to work. It takes away their INCENTIVE to work. Big difference.

Does it though? A lot of rich kids and heirs/heiresses (see my first post upthread) get busy.

I don’t agree with not leaving your kids anything. Financial freedom doesn’t equal laziness, it just means you have room to pursue what you love (maybe traveling, maybe going back to school, maybe trying a career that doesn’t earn you much money but is something you are passionate about). If her kids were raised well — with a healthy respect for money and how to handle it properly, with a grateful attitude that isn’t entitled, etc., an inheritance won’t ruin them.

I completely agree with this. It’s all about how you do it.

Meh. It’s just like they say if you’re bad with money and win the lottery you’ll be broke within a few years. If you’re good with money and win the lottery, it will be amazing. If I have children that were good to me and appreciated everything I did for them, were smart, kind, and good people, I would definitely leave all my money to them because I know they would do good things with it.

I think it’s way more complicated than a black-and-white situation. Teach your kids to value money, try to install a work ethic, make them self-sufficient without you – so if they get some money once you’re gone, it’s an “extra” that can add to their life instead of something they relied on. I totally agree with the overall sentiment that raising kids as trust fund babies can (can, not automatically does) do them a disservice. Surely Marie’s kids have enjoyed the benefit of her wealth already throughout her life.

My mom has a LOT of money saved up, but they’re both still working to get my dad on the same level – and her big nightmare is that she dies and we get to spend it!

I have a friend who inherited – at 60 – enough so she doesn’t have to work and could live very comfortably for decades. But because she was 60, I suspect, she had learned to work and work a lot. She chose to continue for a few more years. You don’t have to be 60 to have learned that. I’m 35 and would never stop working, no matter if I inherited or won the lottery. I just don’t feel like it would be good for me.

It depends on how you raise the kids. Not everyone will have the ability to make enough money to maintain their parents’ lifestyle. So if you plan on leaving them nothing, you may want to raise them in more modest circumstances.

When I was a teenager seeing headlines like that about Sting, I thought that approach was a little heartless. Now that I’m older and have seen in the press the effects that inherited money has on youth (the callousness, aimlessness, drug addiction, and selfishness) I can see how this is a wise choice. If you’ve never had to work for anything, than you can end up valuing nothing. It’s the suffering and labor that teaches most people the value of work and money . That said, I think many wealthy parents do their kids a great disservice in their childhood and teen years by giving them whatever they want, expensive clothing, exotic vacations, cars,etc. if you get them accustomed to that lifestyle, it’s a much harder pattern to break

I know it depends on at which point in their life the parents amass their money, but if I make enough money earlier on, I would rather pay for as much of my children’s college education than leave them money down the line. It would give them greater opportunities to set their lives up.

It’s not like the two – leaving money to your children or money to charity – are mutually exclusive. Personally, my own will pretty much divides equally between my parents (as they’re still alive), my two sons, my brother, and some charities that are important to me. Maybe I’d feel differently if I was super rich and had been able to give my kids all the benefits of that wealth while I was alive, but I’m not, and I can’t imagine leaving nothing to my children.

I’m all for teaching children how to be decent, productive citizens, and maybe giving the very young and immature a pile of cash is problematic. However, I’m in my 50s now, and any money I inherit from my aging parents won’t rob me of work. I’ve worked my ass off, and now I’m sandwiched between care-giving for children and parents. An inheritance means I *might* enjoy something of a retirement, not suddenly become an entitled asshole. If you don’t trust your children with an inheritance, maybe you didn’t do a great job as parents.

My husband and I run a foundation. The foundation has its own holdings and investments that keep it running and keep it providing scholarships and assistance. My spawn are absolutely going to inherit from our personal money. They are smart, generous, caring people and will do good things with what they get. They already have trust funds from their father (my late husband) that they don’t get until age 30. I have never heard them mention those trusts, which they totally know about. I trust that my first husband, and now my second husband and I, have laid down a solid foundation for them and I am fairly certain they will build on that foundation.

The other poster here is right. Marie worked all her life. The Osmond kids literally worked to keep the family afloat and I understand her reasoning behind not leaving her estate to the kids. I’m pretty sure she’s been supportive of them (paid education, housing whatever they want to follow their own path etc.). That’s all she needs to do. She doesn’t need to leave them a cent when she dies.

It depends on the individual. I know a family where both “kids” have a 1.5 million trust fund and we’re given modest apartments.

One was very spoiled and got away with barely working for her 20s. She had a terrible drug problem that was enabled by her well-intentioned father who inadvertently took away her ability to make decisions for herself or face consequences. It was made harder when she started having kids in her 30s. She was finally cut off at 34 but grandpa pays for the kids private school tuition. She was supposed to get $500k installments at 25, 30, and 35. Now it’s 50, 60, and 70!

Other son used some drugs but never had a serious problem. He’s always had a great work ethic and has been good with money (e.g., maxing out his 401k since day 1). He’s still received benefits in the form of a down payment on his first home after getting married and hand-me-down cars from his dad. But he hasn’t touched his trust and is very aware of living in his means. He lived in the gifted apartment for a few years after college but started renting it out after he got married.

Point being, there are ways to leave your kids money that truly benefits them on both sides. The son says he probably wouldn’t have had kids until his mid-40s if he’d been saddled with a ton of debt while trying to save for a down payment and paying rent. Daughter meanwhile was live-laugh-spend until she got cutoff off. Then it was wail-rage-threaten